Table of Contents

ToggleICICIdirect Login Mobile: Step-by-Step Guide for Easy Access to Your Account

Introduction

ICICIdirect Login Mobile is one of India’s leading online stock trading platforms, offering services that cater to a wide variety of investment needs, including stock trading, mutual funds, fixed deposits, and more. With the rapid growth of smartphone usage, ICICIdirect has made its platform mobile-friendly, allowing investors to manage their portfolios, track market performance, and execute trades with ease, all from the comfort of their smartphones.

This article provides a comprehensive guide to the ICICIdirect login mobile process, detailing everything from logging into the mobile app to troubleshooting login issues. Whether you’re a new user or an experienced investor, this guide will ensure you have all the information you need for a seamless login experience.

Table of Contents

- What is ICICIdirect?

- How to Download the ICICIdirect Mobile App

- Step-by-Step Guide to ICICIdirect Login on Mobile

- Creating an Account

- Logging In for the First Time

- Features of ICICIdirect Mobile App

- Troubleshooting ICICIdirect Mobile Login Issues

- ICICIdirect Login Security: Tips to Protect Your Account

- ICICIdirect Mobile App vs. Web Platform: Which One to Choose?

- ICICIdirect Mobile App: Frequently Asked Questions

- Conclusion

1. What is ICICIdirect?

ICICIdirect is a flagship online trading platform offered by ICICI Securities, a subsidiary of ICICI Bank. It allows users to trade in equities, commodities, currencies, and mutual funds. The platform is widely used for its robust research tools, trading insights, and ease of use.

The ICICIdirect mobile login process enables investors to have complete control over their investment portfolios. Whether you’re trading stocks or investing in mutual funds, logging in on your mobile device ensures you can access your account from anywhere, at any time.

2. How to Download the ICICIdirect Mobile App

Before you can log into your ICICIdirect account using your mobile device, you’ll need to download the ICICIdirect mobile app. Here’s how you can do that:

For Android Users:

- Open the Google Play Store on your Android device.

- Search for “ICICIdirect” in the search bar.

- Select the official ICICIdirect app from the search results.

- Tap Install and wait for the app to be downloaded and installed on your phone.

For iOS Users:

- Open the App Store on your iPhone or iPad.

- Type “ICICIdirect” in the search bar.

- Tap on the ICICIdirect app from the search results.

- Hit Get to download and install the app on your iOS device.

Once installed, you’re ready to log in to your ICICIdirect account via mobile.

3. Step-by-Step Guide to ICICIdirect Login on Mobile

Creating an Account

If you haven’t created an ICICIdirect account yet, follow these simple steps:

- Open the ICICIdirect mobile app.

- Tap on Sign Up or New User Registration.

- Enter your personal details such as name, mobile number, email address, and PAN (Permanent Account Number).

- Follow the instructions to complete your registration, including verifying your identity using Aadhaar or another ID.

- Set up your login credentials, including a strong password.

Once your account is created, you can proceed with the mobile login.

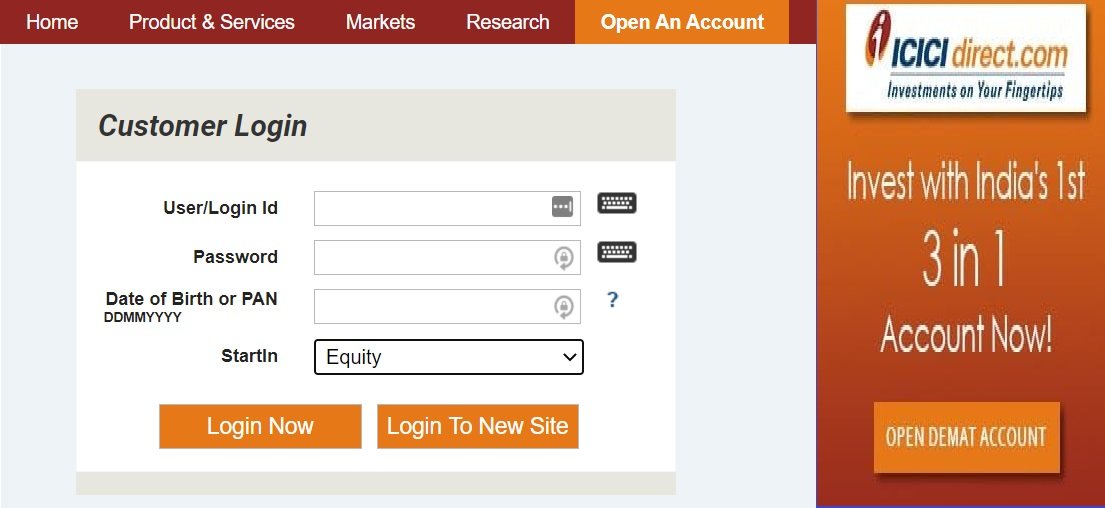

Logging In for the First Time

To log into your ICICIdirect account for the first time on the mobile app:

- Open the ICICIdirect mobile app.

- Enter your User ID and Password (created during registration).

- Tap Login to access your account.

After successful login, you will be able to access all your trading and investment features.

4. Features of ICICIdirect Mobile App

The ICICIdirect mobile app is equipped with a range of features designed to provide users with a comprehensive trading experience. Some key features include:

| Feature | Description |

|---|---|

| Stock Trading | Buy and sell stocks in real-time using the app. |

| Portfolio Management | Track your investment portfolio and view detailed reports. |

| Market Insights | Access live market updates, trends, and expert analysis. |

| Mutual Funds | Invest in and track mutual fund investments. |

| Fund Transfer | Transfer funds easily between your bank account and trading account. |

| Real-time Notifications | Receive alerts for stock prices, news, and important account updates. |

| Research Reports | Access detailed research reports on stocks, sectors, and market conditions. |

These features make it easy for investors to stay on top of their investments and execute trades with a few taps on their smartphones.

5. Troubleshooting ICICIdirect Mobile Login Issues

While logging in to your ICICIdirect mobile account is usually seamless, there may be times when you encounter issues. Here are some common login problems and their solutions:

| Problem | Solution |

|---|---|

| Incorrect User ID or Password | Ensure your credentials are entered correctly. Reset your password if needed. |

| App Not Responding | Close the app and restart it. Try reinstalling if the issue persists. |

| Login Attempt Failed (OTP Not Received) | Check your network connection. Ensure that the phone number linked to your account is correct. |

| Session Timeout | Log in again, ensuring you’re entering the credentials within the allowed time. |

| Account Locked | Contact ICICIdirect support to unlock your account. |

If none of these solutions work, you can always reach out to ICICIdirect customer support for assistance.

6. ICICIdirect Login Security: Tips to Protect Your Account

The security of your investment account is paramount. Here are some tips to enhance your ICICIdirect login security:

- Enable Two-Factor Authentication (2FA): Use a combination of something you know (your password) and something you have (an OTP) to access your account securely.

- Use Strong Passwords: Create a complex password using a mix of letters, numbers, and special characters.

- Keep Your Device Secure: Ensure your mobile device has a screen lock and avoid using public Wi-Fi for logging in.

- Update Your App Regularly: Make sure the ICICIdirect app is always updated to the latest version for improved security features.

- Monitor Account Activity: Regularly review your account activity for any unauthorized trades or changes.

By following these best practices, you can safeguard your account from potential security breaches.

7. ICICIdirect Mobile App vs. Web Platform: Which One to Choose?

Both the mobile app and the web platform offer similar features, but there are key differences that may influence your decision on which one to use:

| Criteria | Mobile App | Web Platform |

|---|---|---|

| Accessibility | Always with you; can log in anytime and anywhere | Requires a laptop or desktop; best for long trading sessions |

| User Interface | Optimized for mobile screens; easy-to-use on the go | More detailed charts and reports; better for in-depth analysis |

| Speed | Fast access for quick trades and updates | May be slower due to device limitations or internet speed |

| Features | Compact version of the web platform’s features | All features available with more advanced tools and reports |

| Battery Usage | Consumes battery over time with continuous use | Less battery drain compared to mobile usage |

8. ICICIdirect Mobile App: Frequently Asked Questions

Q1: How can I recover my ICICIdirect login credentials?

You can recover your login credentials by tapping on the Forgot Password or Forgot User ID option on the login screen and following the prompts.

Q2: Can I trade on ICICIdirect’s mobile app 24/7?

You can trade during market hours (from 9:15 AM to 3:30 PM IST on weekdays). However, the app allows you to track your portfolio 24/7.

Q3: Does ICICIdirect’s mobile app support mutual fund SIPs?

Yes, the app allows you to set up and manage Systematic Investment Plans (SIPs) for mutual fund investments.

9. Conclusion

Logging into your ICICIdirect account via mobile is an easy and secure process that offers convenience for investors. The mobile app provides a host of features designed to make your trading experience as smooth as possible, whether you are a beginner or an experienced investor.